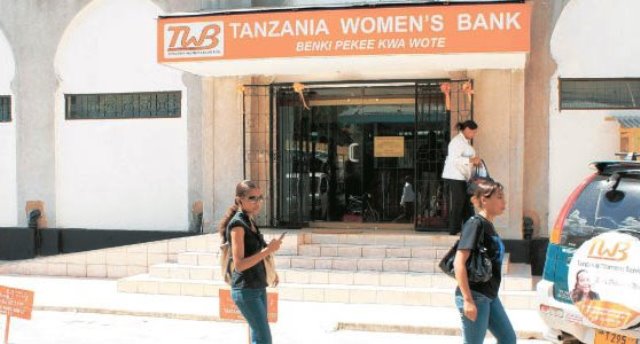

Women bank steadily improves

Thu Nov 02, 2017

The bank posted 610m/- loss in the third quarter of the year according to financial statement made publicly this week, but it recorded strong performance in assets, deposits and nonperforming loans.

TWB Managing Director Japhet Justine told the Daily News that the bank financials in Q3 were promising with deposits increasing by 14 per cent and nonperforming loans dropping 6.0 per cent in three months.

“We are bullish about future prospects since the performance is improving… most importantly, the loan disbursement has gone to the roof,” Mr Justine, who was appointed to the position mid this year, said. He said client disbursed loans went up by 179 per cent to 1,288 people at the end of Q3 compared to 462 at Q2 this year.

The bank’s ingenious product, Solidarity Group Lending, has more than 2.3bn/- disbursed since July and with 53 newly established business centres. In Q2 the bank issued 1.32bn/- loans.

“Yes, we got some losses [in Q3] but the bank is taking shape now” and heading to the right direction, Mr Justine told ‘Daily News’ yesterday. The bank total customer deposits climbed up 14 per cent to 15.81bn/- in three months ending September from 13.83bn/- in June.

The bank gross loan and advances to total deposits grew down to 55 per cent from 65 per cent in a bid to stick on prudential lending.

“We wrote off a number of bad debts to clean our balance sheet. This saw our NPLs decreased by 6 per cent to 7.77bn/- ,” Mr Justine said. Also, the NPL ratio to total gross loan dropped to 51 per cent from 53 per cent.

The bank assets grew to 22.58bn/- in three months from 19.54bn/- at end of June.

TWB has successfully setup more than 350 centres with more than 12,000 clients across the country. Currently the bank serves more than 1,600 women in VICOBA, which enriches the bank’s deposits.

The bank gender client segment favours women with 73 per cent being females and 27 per cent males, while 89 per cent are microfinance groups and 11 per cent SMEs.

SOURCE: DAILY NEWS

Write Your Comments